In The Black: January 2024

Why should you care about interest rates?

Maybe you take a laissez-faire attitude on estimated taxes, preferring to settle up at tax time. Or, perhaps, you have a hard time meeting the Spring deadline and often go on extension.

May I humbly suggest that this year is the year you change your tune? And here’s why. When you are required to pay estimated taxes (business owners- this is you) and you DON’T - the IRS considers them late and charges interest. Same situation for those who file extensions and who owe at the tax deadline but don’t file or pay until later.

Here’s the rub - the Fed’s raised interest rates to 8% (from where they’d been at 3% for a while) so even if I twist myself into a pretzel to get you every deduction possible - if you blow off estimates and/or have a tax bill you don’t pay until the summer… you can just add 8% and there’s nothing I can do about it.

Feel a little spooked? Good!! It’s totally avoidable. START YOUR TAXES NOW.

Get on board with estimated taxes in 2024.

You are a creative person - I’m confident you could find a better way to spend that money.

It’s time to buy an EV. Seriously.

Many of you know that I follow politics almost as closely as I follow tax law. And you may have heard of the Inflation Reduction Act. What some folks didn’t clock is that it’s the biggest green energy investment that we’ve ever made as a country AND it has some mind blowing tax credits and incentives for going green. Today, let’s talk about cars ….

Looking at a new EV? The Clean Vehicle Credit will give you a $7,500 Credit to dollar for dollar reduce your taxes.

Looking at a used EV? 30% of the costs are available as a credit (capped at $4,000).

Looking at an EV for the business? That $7,500 credit allies and if the vehicle is over 14,000pounds (think SUV/van) that credit goes up to $40,000.

Installing a charger for that EV? 30% of the costs are available as a credit.

These are all CREDITS rather than deductions , which is EXTRA exciting. That’s because where a deduction reduces your taxable income, a credit reduces your taxes dollar for dollar.

Here’s Top Gear’s Top 20 Electric Cars now that I have you rev’d up.

Deadlines: a new world order for LIAB.

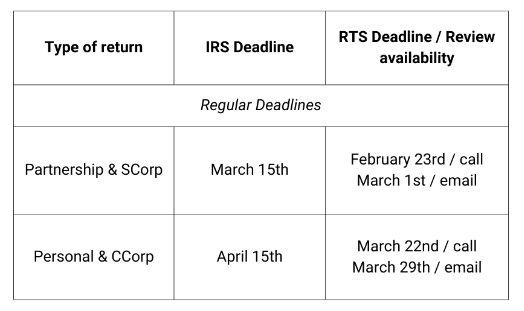

In an effort to make sure that I can talk to everyone about their taxes and preserve both of our sanity - we’ve set up some deadlines around taxes this year. The RTS deadline refers to ‘Ready To Start’ meaning that you’ve turned in all your paperwork and answered our questions by this date. You’ll also notice that this year once you receive your draft - you’ll have a window of 2-3 weeks to have a review call.

Why are we switching this up? So that we can serve you better. It’s impossible to do everyone's taxes and review calls in the two weeks before the deadline and more importantly it’s impossible to give your return the attention it deserves and the review call that’s so essential!!! So I appreciate you helping us help you!!!

Work Wives and Anniversaries

Did you know that Justine and I have been working together for 11 years? It’s our steel anniversary and Oprah suggests a knife as a gift. Sending the wrong message? If you have better ideas- send them my way!